The definition of a medical billing denial is, “the refusal of an insurance company or carrier to honor a request by an individual (or his or her provider) to pay for healthcare services obtained from a healthcare professional.”

In medical practices, medical billing denial rates range from 5-10%. For some medical providers, one out of every five medical claims has to be reworked or appealed which averages about $25 per claim.

The good news is, many medical billing denials can be avoided. True, they may never cease to exist, but reducing them even by a small percentage can have a huge impact on your practice’s earnings. By understanding the different types of billing denials and pinpointing the most common billing problems should enable you to take steps to avoid them.

The top 5 medical billing denials:

- Missing information: A claim form can trigger a denial just by leaving one required field blank. The wrong plan code or no Social Security number, demographic errors, trigger approximately 61% of initial medical billing denials and account for 42% of denial write-offs.

- Duplicate claim or service:Up to 35% Medicare Part B claim denials are claims resubmitted for a visit on the same date for the same beneficiary and the same service item.

- Service already adjudicated:An error of this type occurs when benefits for a certain service are included in the payment/allowance for another service or procedure that has already been adjudicated.

- Not covered by payer:Denials for procedures not covered under patients’ current benefit plan can be avoided by checking the insurance eligibility details in response before administering services.

- Limit for filing expired: Most payers require medical claims to be submitted within a certain number of days of service. This includes the time it takes to rework rejections. 1Correcting patient medical coding errors, which accounts for most claim denials, can cause delays that push medical billing past the deadline.

How to prevent medical billing claim denials

Adding additional staff to your claims management team won’t necessarily help reduce or prevent denials unless they know what aspects to focus on. The following should be included in any sound denials management plan.

- Work with payers to eliminate contract requirements that can often lead to denials overturned on appeal.

- Evaluate and categorize denials by tracking and measuring trends by doctor, procedure and payer. Technology and analytics are essential to reliable business intelligence.

- Improve patient data quality at signup, which is the source of many errors, which ultimately leads to denials.

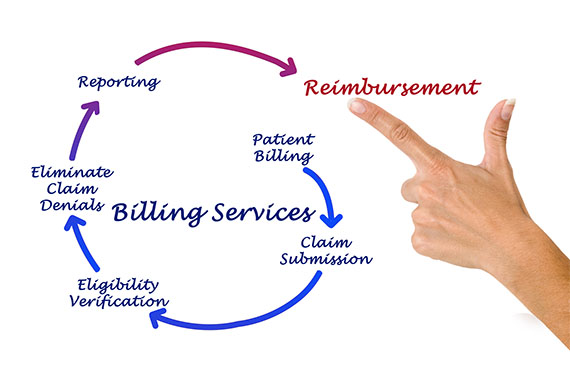

- Create a denials prevention environment in all parts of the revenue cycle including patient medical records, accounting, coding and compliance.

- Optimize claims management software to ensure edits are functioning and improving your clean claims rate.

- Use automated predictive analytics to flag potential denials which will enable staff to address them before claims are submitted.

Outsourcing revenue cycle management to experts like RevPro Healthcare Solutions who have dedicated denials management teams can be a profitable, sustainable solution for healthcare providers. Contact us below or call us at 561-578-8400.

Share this article: